Even as cost-per-install rates soar, the cost of loyal users is going down. Here's what businesses building mobile apps should know.

|

| Image: iStockphoto/Nongkran_ch |

Apple's App Store may have created 1.9 million jobs, but it's unclear how many of those jobs pay a living wage. After all,

VisionMobile's survey data has long revealed that most developers live below the app poverty line, making less than $500 per app per month.

There are signs, however, that life is getting better for mobile app developers.

App Annie, for example, is

forecasting that the App Store will generate $101 billion by 2020. More importantly, however, the cost for acquiring a loyal app user, and not simply someone who installs an app, is in decline. With roughly 30% of all mobile advertising currently focused on getting people to download apps, everyone benefits if those billions of dollars start to create real brand loyalty, and not simply app churn.

Loyalty comes at a price

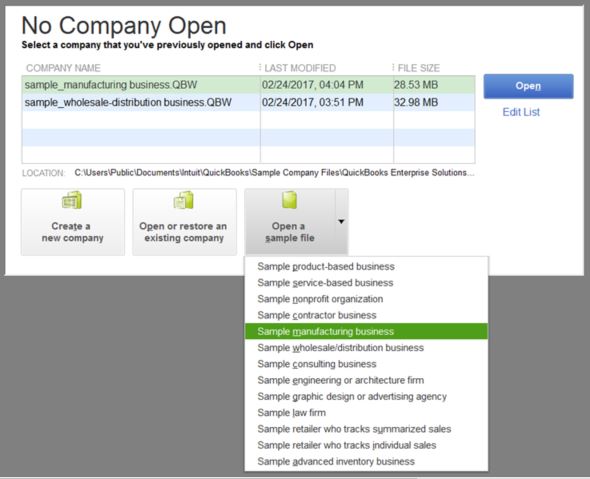

The cause for hope comes from recent Fiksu data. Fiksu, which specializes in helping brands build and run app acquisition and re-engagement campaigns, issues a

monthly index that tracks the cost of generating app downloads and app loyalty, defined as a user that opens an app three times. Those numbers show though the cost per install (CPI) keeps going up, the cost per loyal user (CPLU) has declined a bit over the past year.

On iOS, CPI rose 12% to $1.64, a 28% increase over January 2015. On Android, CPI went the opposite direction, declining 44% to $1.91 from December 2015 while rising 25% since January 2016:

Now, compare this to the cost of acquiring a loyal user (CPLU), which plunged 34% since last month to $2.78, and experienced a year-over-year decline of 4%:

In short, the cost of corralling new users into your apps keeps going up, but the cost of generating loyal users seemingly paradoxically has been going down.

What gives?

Are we there yet?

The Verge's

Casey Newton writes that "the App Store's middle class is small and shrinking. And the easy money is gone," which is correct, but doesn't tell the whole story.

For one thing, more and more companies aren't even trying to sell apps. Either they offer in-app purchases or, if they're a big brand like a hotel chain, they generate revenue through their app. For these companies, it doesn't matter whether the App Store economy is $101 billion or $1.01, because the revenue they generate is facilitated by apps but not counted as part of the "app economy."

Selling apps, in other words, is old school.

This is implied by the Fiksu data. When I asked Fiksu co-founder Micah Adler why CPLU has declined even as CPI has gone up, he made it clear that it has a lot to do with "higher quality" of installs.And yet, big brands still need to find ways to get users to download and engage with their apps, and so should be concerned by CPI inflation. The good news is that mobile marketers appear to be getting better at generating app loyalty, and not merely app installs.

"This is because the average install this year has a higher likelihood of turning into a loyal user, compared to last year," Adler said. "So, even though it is more expensive to get a download, this is more than made up for by the higher quality."

By higher quality Adler really means better use of data, or "the ability to extract the right audiences from that data," as he told me. "By getting the right people to download the app, they are more likely to be long term users of the app."

Spending on engagement

Adler's response is understandably focused on optimization of ad spend, given that's what Fiksu does. But, lost in that analysis are the myriad other things that app developers are doing to foster loyalty in their user base.

While companies have

increasingly focused on app engagement for years, it's only been in the last year that mobile marketing automation and related technologies have become

more science than art. What used to be "dumb pipes" has become real-time, data-driven orchestration of notifications that nudge a user along a desired purchasing path.

Between optimized app user acquisition campaigns and ongoing improvements in engagement strategies, marketers are finally starting to get real value for their mobile marketing spend. That's good news for the app economy, but it's great news for every business that depends on mobile...which is every business.